This page will hopefully help understand the essential things that are needed to qualify for a mortgage loan. There are many factors that come into play but this guide will serve as a great reference to knowing what’s needed.

Many people have asked me what it takes to qualify. Well, there can be multiple answers to that but the core comes to two main factors. Credit score and employment. Although it may sound as something so simple this can sometimes be confusing.

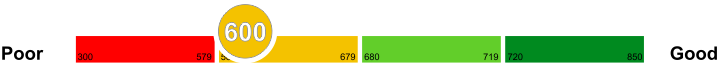

The general rule is a credit score above 600. Although there may be lenders that can go lower, generally I have seen this as a cut off point. The second thing is having work history for the past 2 yrs. This does not have to be in the same job but it does have to be continuos employment.

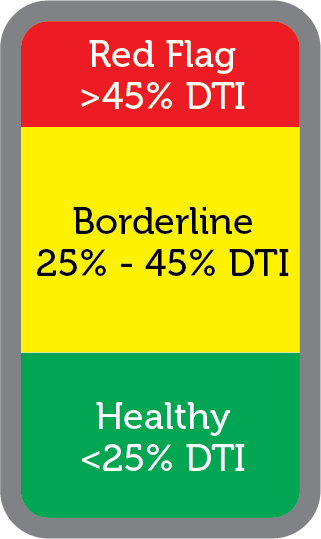

If both of those things look good, the lender will look into your affordability. This will also be different depending on the lender as each one may have their own limits. As a general rule 45% DTI (Debt To Income) is a good starting point. FHA loan will typically allow higher DTI’s than Conventional so make sure you keep that in mind.

On that note, there are different types of loans so make sure you ask your lender what the best options will be for you. They will be able to better guide you as they will have all the information needed in front of them. Your most common will be FHA which will require 3.5% down payment and Conventional with 5% down payment. There are also VA Loans, RD Loans and Portfolio loans so having your lender guide you through the pros and cons of each would be recommended. Keep in mind not all buyers will qualify for all loan types.